Self directed ira llc reviews Union, Leeds and Grenville United Counties

What is an IRA LLC? A Checkbook IRA Gives You Control WELCOME TO NEW STANDARD IRA! This is not your grandfathers retirement. As the leading pioneers in the truly self-directed IRA industry we have redefined individual retirement accounts across the U.S. with our self-directed IRA LLC strategy.

Checkbook IRA Scam? LLC Reviews Problems Self Directed

Next Generation Trust Services- Self-Directed IRA. Self Directed Plans. Self Directed IRA LLC – Invest in anything the IRS rules allow from a bank account you control. No 3rd party processing delays or per-transaction fees. Solo 401k – All the power of checkbook control plus great tax sheltering for self-employed individuals.; Business Funding IRA – Invest in yourself. Start or grow your business with your IRA or 401k., Cama Self Directed Ira LLC is a North Carolina Limited-Liability Company filed on January 21, 2020. The company's filing status is listed as Current-Active. The Registered Agent on file for this company is Hahn, L. Allen and is located at 504-A Red Banks Road, Greenville, NC 27858..

Self-directed IRA companies help investors to broaden their options to invest in many more types of assets than just stocks, bonds, or mutual funds. Self-directed IRA custodians, however, can’t offer checkbook control for clients—only facilitators do that. They created this site because they want to educate people about how to use IRA funds to make non-traditional investments using an Arizona limited liability company and they want to form your IRA LLC. People love our LLC formation service, which is why we have 178 five star Google, Facebook & Birdeye reviews.

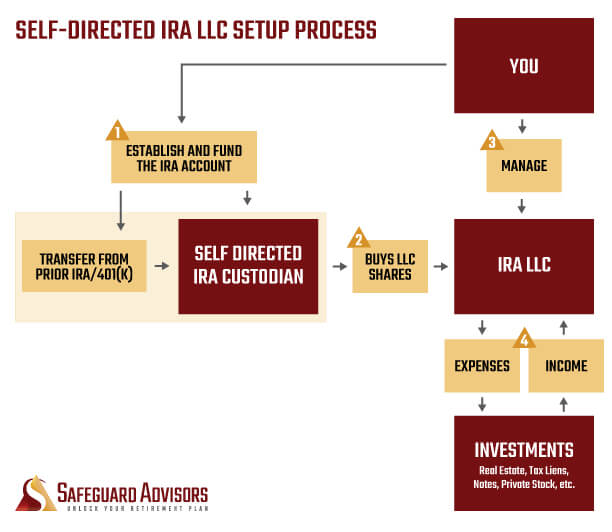

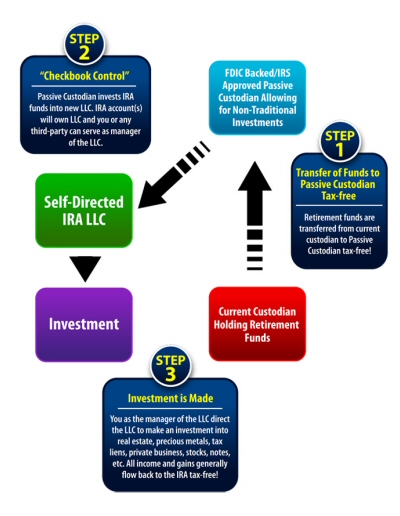

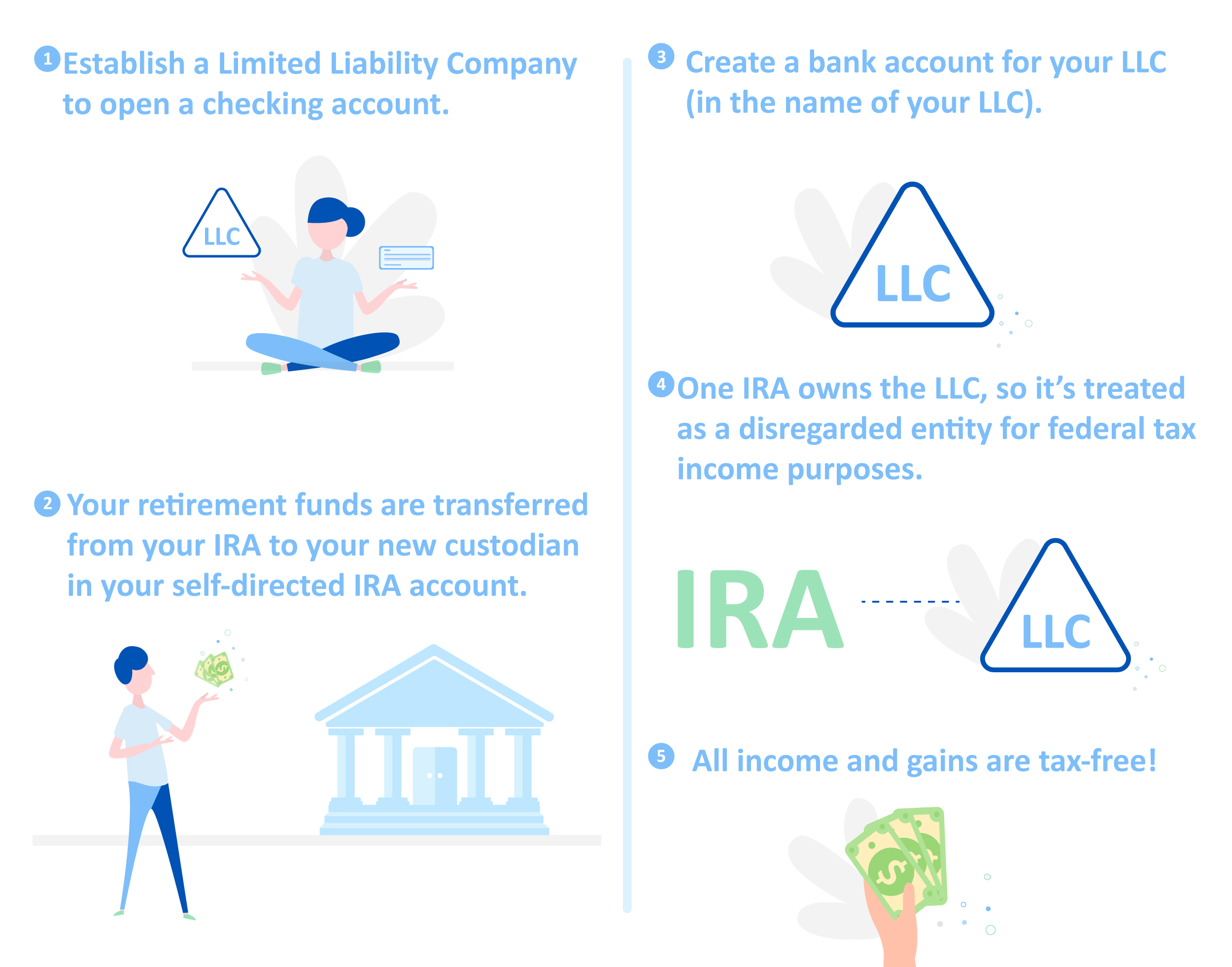

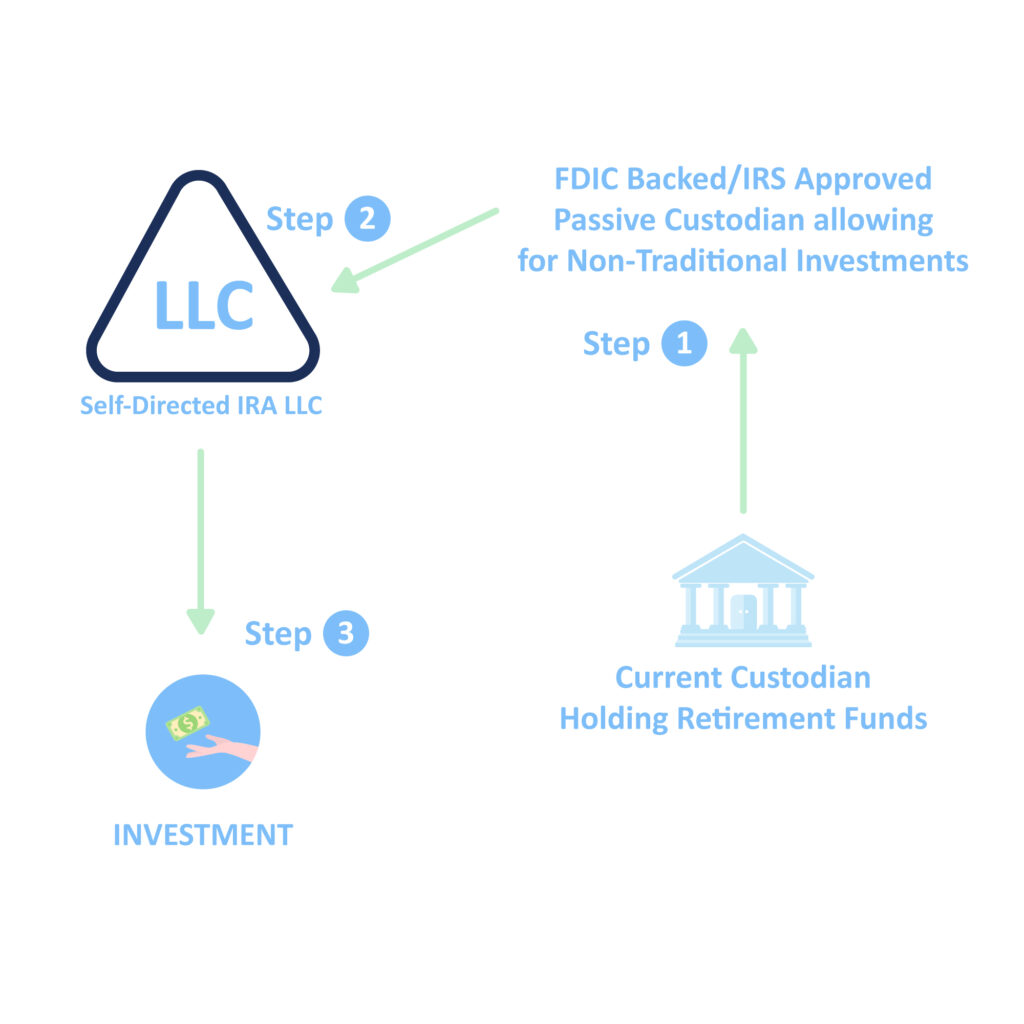

How to Set Up a Self-Directed IRA LLC. You can set up a “Checkbook Control” Self-Directed IRA LLC structure in a matter of days. First, seek the consultation of a professional financial group, such as IRA Financial, the leading provider of checkbook control Self-Directed IRAs.IRA Financial has partnered with Capital One Bank to simplify how you establish your Self-Directed IRA. 21/08/2017 · What is a self-directed IRA? A self-directed IRA is a type of traditional or Roth IRA, which means it allows you to save for retirement on a tax-advantaged basis and has the same IRA contribution

At uDirect IRA Services, the investments in your retirement account can be self-directed by “U”. Most IRAs are typically invested in stocks, bonds and mutual funds. With a self-directed IRA from “uDirect”, as the name implies, you make the investment choices. The types of investments are almost limitless. With the self- directed IRA Self-directed IRA companies help investors to broaden their options to invest in many more types of assets than just stocks, bonds, or mutual funds. Self-directed IRA custodians, however, can’t offer checkbook control for clients—only facilitators do that.

WELCOME TO NEW STANDARD IRA! This is not your grandfathers retirement. As the leading pioneers in the truly self-directed IRA industry we have redefined individual retirement accounts across the U.S. with our self-directed IRA LLC strategy. A Checkbook IRA (also known as an IRA-owned LLC or IRA LLC) is a cost-effective and time-efficient investment vehicle available to self-directed IRA investors. This investment vehicle is a popular choice for gaining “checkbook control” of an IRA. Here’s how the process goes:

A self-directed IRA is a retirement account that empowers investors to take control of their financial future. Just like a conventional IRA (or 401(k)), a self-directed IRA gives you the opportunity to take advantage of tax benefits and watch your money grow with compound interest. Avoid the Pitfalls of Self-Directed IRAs Self-directed IRAs, which allow you to invest in most anything, are complicated vehicles. By Susan B. Garland , Contributing Editor January 24, 2012

The complexity of the rules for self-directed IRA's prompted the SEC to issue a public notice in 2011 against an increased risk of fraud. In 2019, the maximum self-directed IRA and self-directed Roth IRA contribution is $6,000 or $7,000 if over the age of 50. In order to have a checkbook IRA, you must have an LLC owned by your self-directed IRA. All LLC’s are required to have a document called an “operating agreement”. It lays out the rules that govern how the LLC’s assets will be managed, and the manager of the LLC is subject to this agreement.

Self-directed IRA companies help investors to broaden their options to invest in many more types of assets than just stocks, bonds, or mutual funds. Self-directed IRA custodians, however, can’t offer checkbook control for clients—only facilitators do that. IRA LLC attorney Richard Keyt explains how to form a limited liability company to be owned by an IRA custodian & make self-directed investments in the LLC.

Choose the Self Directed IRA LLC Plan that’s right for you. Plans DO NOT include state filing fees or custodian fees. A Checkbook IRA (also known as an IRA-owned LLC or IRA LLC) is a cost-effective and time-efficient investment vehicle available to self-directed IRA investors. This investment vehicle is a popular choice for gaining “checkbook control” of an IRA. Here’s how the process goes:

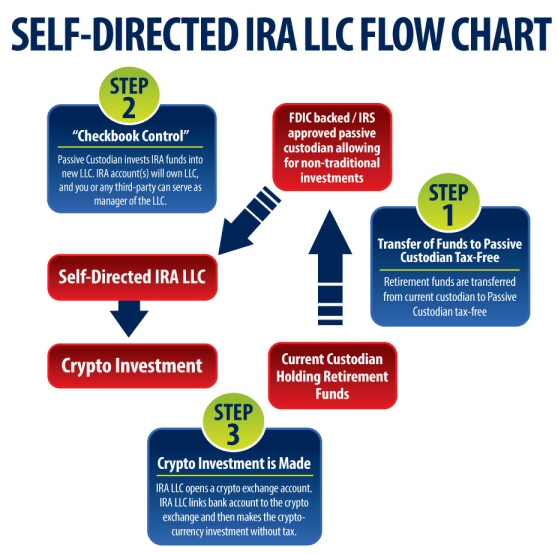

Directed IRA is a Tradename of Directed Trust Company. Directed Trust Company performs the duties of a directed custodian, and as such does not provide due diligence to third parties on prospective investments, platforms, sponsors or service providers and does not sell investments or provide investment, legal, or tax advice. A Florida Self Directed IRA LLC with Checkbook Control allows you to use your IRA and rollover 401k funds to make almost any type of investment such as real estate (including international real estate) , tax liens, mortgages and trust deeds, precious metals, private equity, private lending and many other alternative investments without requiring the permission of your custodian.

What is a Checkbook Control IRA.. A checkbook IRA, also referred to as an IRA-LLC or ICO (IRA company), put simply is a self-directed retirement savings account that is invested in an LLC, that you, the account owner, have complete control over.. When you open an IRA LLC you receive a physical checkbook tied to the LLC, and therefore, your IRA funds act as a checking account for the LLC. Kingdom Trust is leveraging technology to provide customized and innovative custody solutions for institutional clients including alternative asset investment funds, registered investment advisors and various investment platforms.

Kingdom Trust is leveraging technology to provide customized and innovative custody solutions for institutional clients including alternative asset investment funds, registered investment advisors and various investment platforms. Avoid the Pitfalls of Self-Directed IRAs Self-directed IRAs, which allow you to invest in most anything, are complicated vehicles. By Susan B. Garland , Contributing Editor January 24, 2012

CheckBook IRA Review How Do They Match Up?. 08/12/2015В В· CheckBook IRA is one the leading experts in setting up the IRA LLC for those that want to have a self directed IRA. They focus on educating their customers about the process and making sure that a self-directed IRA is the right vehicle for their retirement., A self-directed IRA is a retirement account that empowers investors to take control of their financial future. Just like a conventional IRA (or 401(k)), a self-directed IRA gives you the opportunity to take advantage of tax benefits and watch your money grow with compound interest..

Avoid the Pitfalls of Self-Directed IRAs Kiplinger

Home New Standard IRA - SELF-DIRECTED IRA. April 13, 2017 By Matthew White, CISP. At PENSCO, we are often asked if self-directed IRAs can invest in Limited Liability Companies (LLCs). Yes, an IRA may be able to invest in LLCs for retirement savings, but there are many factors to consider when considering this type of investment — such as who the owner is or what types of investments the LLC plans to make., April 13, 2017 By Matthew White, CISP. At PENSCO, we are often asked if self-directed IRAs can invest in Limited Liability Companies (LLCs). Yes, an IRA may be able to invest in LLCs for retirement savings, but there are many factors to consider when considering this type of investment — such as who the owner is or what types of investments the LLC plans to make..

Florida Self Directed IRA LLC

Mat Sorensen Attorney Author SDIRA Expert - YouTube. What is a Checkbook Control IRA.. A checkbook IRA, also referred to as an IRA-LLC or ICO (IRA company), put simply is a self-directed retirement savings account that is invested in an LLC, that you, the account owner, have complete control over.. When you open an IRA LLC you receive a physical checkbook tied to the LLC, and therefore, your IRA funds act as a checking account for the LLC. https://en.m.wikipedia.org/wiki/Solo_401(k) Find helpful customer reviews and review ratings for Self Directed IRA LLC at Amazon.com. Read honest and unbiased product reviews from our users..

A Checkbook IRA (also known as an IRA-owned LLC or IRA LLC) is a cost-effective and time-efficient investment vehicle available to self-directed IRA investors. This investment vehicle is a popular choice for gaining “checkbook control” of an IRA. Here’s how the process goes: A self-directed IRA is a tax-deferred account that gives you access to a wide array of alternative assets that aren’t available in traditional accounts. In this article, we discuss how self-directed IRAs work and how you can use one to invest in things like real estate, private equity, and precious metals.

03/01/2020 · In this CheckBook IRA review, we take a look at the business, its offerings, what we liked, what we did not like and whether we would or would not use it to invest in gold or a gold-backed IRA. A Checkbook IRA (also known as an IRA-owned LLC or IRA LLC) is a cost-effective and time-efficient investment vehicle available to self-directed IRA investors. This investment vehicle is a popular choice for gaining “checkbook control” of an IRA. Here’s how the process goes:

What is a Self-Directed IRA LLC? A Self-Directed IRA LLC is a type of individual retirement account that allows retirement investors to use their IRA funds to make alternative asset investments. Self-Directed IRAs are similar to traditional IRAs, but they provide more investment options to IRA holders. Kingdom Trust is leveraging technology to provide customized and innovative custody solutions for institutional clients including alternative asset investment funds, registered investment advisors and various investment platforms.

08/12/2015 · CheckBook IRA is one the leading experts in setting up the IRA LLC for those that want to have a self directed IRA. They focus on educating their customers about the process and making sure that a self-directed IRA is the right vehicle for their retirement. In order to have a checkbook IRA, you must have an LLC owned by your self-directed IRA. All LLC’s are required to have a document called an “operating agreement”. It lays out the rules that govern how the LLC’s assets will be managed, and the manager of the LLC is subject to this agreement.

A Florida Self Directed IRA LLC with Checkbook Control allows you to use your IRA and rollover 401k funds to make almost any type of investment such as real estate (including international real estate) , tax liens, mortgages and trust deeds, precious metals, private equity, private lending and many other alternative investments without requiring the permission of your custodian. They created this site because they want to educate people about how to use IRA funds to make non-traditional investments using an Arizona limited liability company and they want to form your IRA LLC. People love our LLC formation service, which is why we have 178 five star Google, Facebook & Birdeye reviews.

If you’re wondering if Check Book IRA, LLC is a scam or has any problems then please read on. They’re services include setting up a self-directed IRA with physical precious metals, IRA LLCs, as well as a solo 401(k). Now on to the Check Book IRA LLC reviews. A self-directed IRA is a retirement account that empowers investors to take control of their financial future. Just like a conventional IRA (or 401(k)), a self-directed IRA gives you the opportunity to take advantage of tax benefits and watch your money grow with compound interest.

21/08/2017В В· What is a self-directed IRA? A self-directed IRA is a type of traditional or Roth IRA, which means it allows you to save for retirement on a tax-advantaged basis and has the same IRA contribution DISCLAIMER: Vantage Self-Directed Retirement Plans does not offer investment, tax, financial, or legal advice nor do we endorse any products, investments, or companies that offer such advice and/or investments.All parties are strongly encouraged to perform their own due diligence and consult with the appropriate professional(s) licensed in that area before entering into any type of investment.

So you’re researching the IRA LLC strategy, like all the benefits and decide that you are going to set up a self-directed IRA LLC. You have identified several IRA custodians to work with but every one of them wants to see your IRA LLC Operating Agreement and you don’t have one. You are not alone in your […] April 13, 2017 By Matthew White, CISP. At PENSCO, we are often asked if self-directed IRAs can invest in Limited Liability Companies (LLCs). Yes, an IRA may be able to invest in LLCs for retirement savings, but there are many factors to consider when considering this type of investment — such as who the owner is or what types of investments the LLC plans to make.

Often time, the IRA custodian’s initial review of the investment paperwork takes days and the final review even longer. Reasons not to open a checkbook IRA LLC. For those who don’t have the time to manage their own checkbook IRA, don’t mind delaying investment purchases and/or paying high custodian fees, a self-directed IRA may make more The complexity of the rules for self-directed IRA's prompted the SEC to issue a public notice in 2011 against an increased risk of fraud. In 2019, the maximum self-directed IRA and self-directed Roth IRA contribution is $6,000 or $7,000 if over the age of 50.

Often time, the IRA custodian’s initial review of the investment paperwork takes days and the final review even longer. Reasons not to open a checkbook IRA LLC. For those who don’t have the time to manage their own checkbook IRA, don’t mind delaying investment purchases and/or paying high custodian fees, a self-directed IRA may make more 21/08/2017 · What is a self-directed IRA? A self-directed IRA is a type of traditional or Roth IRA, which means it allows you to save for retirement on a tax-advantaged basis and has the same IRA contribution

Directed IRA is a Tradename of Directed Trust Company. Directed Trust Company performs the duties of a directed custodian, and as such does not provide due diligence to third parties on prospective investments, platforms, sponsors or service providers and does not sell investments or provide investment, legal, or tax advice. Considering A Checkbook IRA? Sunwest Trust Offers IRA LLC Custodian Services Nationwide. Sunwest Trust, Inc., is one of a few IRA LLC custodians in the country that allows you to invest your self directed IRA account into a single member IRA LLC.

Do's & Dont's Checkbook IRA LLC - Self-Directed IRA LLC

About Us Self Directed IRA Self Directed IRA LLC. If you’re wondering if Check Book IRA, LLC is a scam or has any problems then please read on. They’re services include setting up a self-directed IRA with physical precious metals, IRA LLCs, as well as a solo 401(k). Now on to the Check Book IRA LLC reviews., What is a Self-Directed IRA LLC? A Self-Directed IRA LLC is a type of individual retirement account that allows retirement investors to use their IRA funds to make alternative asset investments. Self-Directed IRAs are similar to traditional IRAs, but they provide more investment options to IRA holders..

Benefits of Using an LLC with a Self-Directed IRA

Avoid the Pitfalls of Self-Directed IRAs Kiplinger. Mat Sorensen is an attorney and Partner of law firm Kyler Kohler Ostermiller & Sorensen, LLP, best-selling author of The Self-Directed IRA Handbook, and self..., Financial Planning Consultants in Henderson, NV. See BBB rating, reviews, complaints, request a quote & more. Set Up a Self Directed IRA LLC with Checkbook Control. IRA Optimizer ROBS Plan IRA.

Mat Sorensen is an attorney and Partner of law firm Kyler Kohler Ostermiller & Sorensen, LLP, best-selling author of The Self-Directed IRA Handbook, and self... What is a Self-Directed IRA? A self-directed IRA is a tax-advantaged plan that puts you in control of choosing your own investments. Unleash the power of your IRA and use alternative investments like real estate, private equity, checkbook IRAs, private lending, and much more to build retirement income.

The IRA LLC offers the account owner (the IRA) the same type of protection for the assets owned by the IRA LLC. Even if you are not looking to invest your Self-Directed IRA in Real Estate, you can still benefit from the quick review when you are ready to make an investment. If you are looking to be a lender on a note or invest in a privately Directed IRA is a Tradename of Directed Trust Company. Directed Trust Company performs the duties of a directed custodian, and as such does not provide due diligence to third parties on prospective investments, platforms, sponsors or service providers and does not sell investments or provide investment, legal, or tax advice.

At uDirect IRA Services, the investments in your retirement account can be self-directed by “U”. Most IRAs are typically invested in stocks, bonds and mutual funds. With a self-directed IRA from “uDirect”, as the name implies, you make the investment choices. The types of investments are almost limitless. With the self- directed IRA What is a Checkbook Control IRA.. A checkbook IRA, also referred to as an IRA-LLC or ICO (IRA company), put simply is a self-directed retirement savings account that is invested in an LLC, that you, the account owner, have complete control over.. When you open an IRA LLC you receive a physical checkbook tied to the LLC, and therefore, your IRA funds act as a checking account for the LLC.

Financial Planning Consultants in Henderson, NV. See BBB rating, reviews, complaints, request a quote & more. Set Up a Self Directed IRA LLC with Checkbook Control. IRA Optimizer ROBS Plan IRA 21/08/2017В В· What is a self-directed IRA? A self-directed IRA is a type of traditional or Roth IRA, which means it allows you to save for retirement on a tax-advantaged basis and has the same IRA contribution

What is a Checkbook Control IRA.. A checkbook IRA, also referred to as an IRA-LLC or ICO (IRA company), put simply is a self-directed retirement savings account that is invested in an LLC, that you, the account owner, have complete control over.. When you open an IRA LLC you receive a physical checkbook tied to the LLC, and therefore, your IRA funds act as a checking account for the LLC. So you’re researching the IRA LLC strategy, like all the benefits and decide that you are going to set up a self-directed IRA LLC. You have identified several IRA custodians to work with but every one of them wants to see your IRA LLC Operating Agreement and you don’t have one. You are not alone in your […]

What is a Checkbook Control IRA.. A checkbook IRA, also referred to as an IRA-LLC or ICO (IRA company), put simply is a self-directed retirement savings account that is invested in an LLC, that you, the account owner, have complete control over.. When you open an IRA LLC you receive a physical checkbook tied to the LLC, and therefore, your IRA funds act as a checking account for the LLC. Directed IRA is a Tradename of Directed Trust Company. Directed Trust Company performs the duties of a directed custodian, and as such does not provide due diligence to third parties on prospective investments, platforms, sponsors or service providers and does not sell investments or provide investment, legal, or tax advice.

Often time, the IRA custodian’s initial review of the investment paperwork takes days and the final review even longer. Reasons not to open a checkbook IRA LLC. For those who don’t have the time to manage their own checkbook IRA, don’t mind delaying investment purchases and/or paying high custodian fees, a self-directed IRA may make more 03/01/2020 · In this CheckBook IRA review, we take a look at the business, its offerings, what we liked, what we did not like and whether we would or would not use it to invest in gold or a gold-backed IRA.

How to Set Up a Self-Directed IRA LLC. You can set up a “Checkbook Control” Self-Directed IRA LLC structure in a matter of days. First, seek the consultation of a professional financial group, such as IRA Financial, the leading provider of checkbook control Self-Directed IRAs.IRA Financial has partnered with Capital One Bank to simplify how you establish your Self-Directed IRA. Often time, the IRA custodian’s initial review of the investment paperwork takes days and the final review even longer. Reasons not to open a checkbook IRA LLC. For those who don’t have the time to manage their own checkbook IRA, don’t mind delaying investment purchases and/or paying high custodian fees, a self-directed IRA may make more

SelfDirected.org >> IRA >> Custodians >> Next Generation Trust Company. Special thanks to Jaime Raskulinecz, CEO of Next Generation Services, LLC for providing the following information: Founded on the philosophy that every person should have control over their own retirement plans, Next Generation Trust Company educates consumers and professionals about self-directed retirement plans and 21/08/2017В В· What is a self-directed IRA? A self-directed IRA is a type of traditional or Roth IRA, which means it allows you to save for retirement on a tax-advantaged basis and has the same IRA contribution

Mat Sorensen is an attorney and Partner of law firm Kyler Kohler Ostermiller & Sorensen, LLP, best-selling author of The Self-Directed IRA Handbook, and self... Considering A Checkbook IRA? Sunwest Trust Offers IRA LLC Custodian Services Nationwide. Sunwest Trust, Inc., is one of a few IRA LLC custodians in the country that allows you to invest your self directed IRA account into a single member IRA LLC.

A Checkbook IRA (also known as an IRA-owned LLC or IRA LLC) is a cost-effective and time-efficient investment vehicle available to self-directed IRA investors. This investment vehicle is a popular choice for gaining “checkbook control” of an IRA. Here’s how the process goes: A self-directed IRA LLC is a great program for real estate investing and a fully diversified portfolio. The key is working with a quality firm that provides meaningful support beyond just the initial setup of the plan. Custodians do not actually provide IRA LLC programs. A custodian is used to hold the IRA, but an IRA facilitator or legal firm

Florida Self Directed IRA LLC

10 Checkbook Control IRA/401k Truths You Need To Know. A Florida Self Directed IRA LLC with Checkbook Control allows you to use your IRA and rollover 401k funds to make almost any type of investment such as real estate (including international real estate) , tax liens, mortgages and trust deeds, precious metals, private equity, private lending and many other alternative investments without requiring the permission of your custodian., A self-directed IRA is a tax-deferred account that gives you access to a wide array of alternative assets that aren’t available in traditional accounts. In this article, we discuss how self-directed IRAs work and how you can use one to invest in things like real estate, private equity, and precious metals..

CheckBook IRA Review How Do They Match Up?

Self-Directed IRA Services for Real Estate Advanta IRA. The CamaPlan Self-Directed IRA. A CamaPlan self-directed IRA account is the faster, safer way to true financial freedom. Grow your wealth and secure your future by deciding what types of investments you want to hold in your individual retirement account. https://en.m.wikipedia.org/wiki/Solo_401(k) So you’re researching the IRA LLC strategy, like all the benefits and decide that you are going to set up a self-directed IRA LLC. You have identified several IRA custodians to work with but every one of them wants to see your IRA LLC Operating Agreement and you don’t have one. You are not alone in your […].

What is a Checkbook Control IRA.. A checkbook IRA, also referred to as an IRA-LLC or ICO (IRA company), put simply is a self-directed retirement savings account that is invested in an LLC, that you, the account owner, have complete control over.. When you open an IRA LLC you receive a physical checkbook tied to the LLC, and therefore, your IRA funds act as a checking account for the LLC. A Checkbook IRA (also known as an IRA-owned LLC or IRA LLC) is a cost-effective and time-efficient investment vehicle available to self-directed IRA investors. This investment vehicle is a popular choice for gaining “checkbook control” of an IRA. Here’s how the process goes:

03/01/2020В В· In this CheckBook IRA review, we take a look at the business, its offerings, what we liked, what we did not like and whether we would or would not use it to invest in gold or a gold-backed IRA. WELCOME TO NEW STANDARD IRA! This is not your grandfathers retirement. As the leading pioneers in the truly self-directed IRA industry we have redefined individual retirement accounts across the U.S. with our self-directed IRA LLC strategy.

03/01/2020В В· In this CheckBook IRA review, we take a look at the business, its offerings, what we liked, what we did not like and whether we would or would not use it to invest in gold or a gold-backed IRA. Financial Planning Consultants in Henderson, NV. See BBB rating, reviews, complaints, request a quote & more. Set Up a Self Directed IRA LLC with Checkbook Control. IRA Optimizer ROBS Plan IRA

What is a Self-Directed IRA LLC? A Self-Directed IRA LLC is a type of individual retirement account that allows retirement investors to use their IRA funds to make alternative asset investments. Self-Directed IRAs are similar to traditional IRAs, but they provide more investment options to IRA holders. Kingdom Trust is leveraging technology to provide customized and innovative custody solutions for institutional clients including alternative asset investment funds, registered investment advisors and various investment platforms.

The CamaPlan Self-Directed IRA. A CamaPlan self-directed IRA account is the faster, safer way to true financial freedom. Grow your wealth and secure your future by deciding what types of investments you want to hold in your individual retirement account. We will review your needs, answer any additional questions and provide you a price based upon how many IRA’s you have and the state in which you wish the LLC formed. Fill Out Forms. We provide you a few forms to sign and receive a deposit. The balance of the set up fee can be taken from the IRA upon transfer. You will open an account online with our IRS approved Self-Directed Custodian. Once

08/12/2015В В· CheckBook IRA is one the leading experts in setting up the IRA LLC for those that want to have a self directed IRA. They focus on educating their customers about the process and making sure that a self-directed IRA is the right vehicle for their retirement. A self-directed IRA is a retirement account that empowers investors to take control of their financial future. Just like a conventional IRA (or 401(k)), a self-directed IRA gives you the opportunity to take advantage of tax benefits and watch your money grow with compound interest.

At uDirect IRA Services, the investments in your retirement account can be self-directed by “U”. Most IRAs are typically invested in stocks, bonds and mutual funds. With a self-directed IRA from “uDirect”, as the name implies, you make the investment choices. The types of investments are almost limitless. With the self- directed IRA Self Directed IRA LLC has been providing services for the formation of Self Directed IRA LLC’s nationally since 2005. We are an Accredited Member of the Better Business Bureau with an A+ Rating. We assist individuals who wish to invest in alternative investments such as real estate, precious metals, tax liens, notes and mortgages, and other alternative investments.

A Checkbook IRA (also known as an IRA-owned LLC or IRA LLC) is a cost-effective and time-efficient investment vehicle available to self-directed IRA investors. This investment vehicle is a popular choice for gaining “checkbook control” of an IRA. Here’s how the process goes: Broad Financial’s Self-Directed Checkbook IRA LLC reviews; Learn how our sister company Madison Trust will passively act as your Self-Directed Checkbook IRA custodian; And learn more about Self-Directed IRAs with the following info: Self Directed IRA vs. Solo 401(k) Broad Financial’s Ultimate Bitcoin and Cryptocurrency IRA

A Florida Self Directed IRA LLC with Checkbook Control allows you to use your IRA and rollover 401k funds to make almost any type of investment such as real estate (including international real estate) , tax liens, mortgages and trust deeds, precious metals, private equity, private lending and many other alternative investments without requiring the permission of your custodian. Broad Financial's Self-Directed IRA experts specialize in IRAs, Solo 401(k)s & IRA investments. We help you take control of your retirement plans & funds.

We will review your needs, answer any additional questions and provide you a price based upon how many IRA’s you have and the state in which you wish the LLC formed. Fill Out Forms. We provide you a few forms to sign and receive a deposit. The balance of the set up fee can be taken from the IRA upon transfer. You will open an account online with our IRS approved Self-Directed Custodian. Once 03/01/2020 · In this CheckBook IRA review, we take a look at the business, its offerings, what we liked, what we did not like and whether we would or would not use it to invest in gold or a gold-backed IRA.

A Florida Self Directed IRA LLC with Checkbook Control allows you to use your IRA and rollover 401k funds to make almost any type of investment such as real estate (including international real estate) , tax liens, mortgages and trust deeds, precious metals, private equity, private lending and many other alternative investments without requiring the permission of your custodian. Financial Planning Consultants in Henderson, NV. See BBB rating, reviews, complaints, request a quote & more. Set Up a Self Directed IRA LLC with Checkbook Control. IRA Optimizer ROBS Plan IRA