Thematic review on risk governance Nellie Lake

Consumer Protection issues in travel insurance A thematic MFSA conducts a Thematic Review on Governance, Compliance and Risk Management with respect to Investment Services Licence Holders On the 22nd December 2015, the MFSA issued a letter to the Compliance Officers of Investment Services Licence Holders to inform them of the shortcomings the MFSA identified during focused reviews which it carried out on investment services providers licensed …

Thematic Review School Governance

(PDF) Thematic Review on Risk Governance Peer Review. During late 2016 a thematic review of fund managers and fund administrators' governance, risk and compliance frameworks was jointly undertaken by the Investment Supervision and Policy Division and the Financial Crime Supervision and Policy Division of the Commission., Thematic Review Team-Asset Management Supervision Our Role. The Thematic Review Team is a cross-Directorate review team responsible for conducting themed reviews on a range of supervisory topics, with a view to assessing if firms are complying with the applicable regulations and are utilising good practice in relation to the topic in terms of policies, controls and procedures..

Cybersecurity Risks in September 2016, which was circulated to all credit unions, setting out guidance in relation to IT governance and IT risk management. This report reinforces the expectations articulated in that paper on the areas covered in this IT Thematic review. The Financial Stability Board (FSB) published today a thematic peer review on risk governance.The report takes stock of risk governance practices at both national authorities and firms, notes progress made since the financial crisis, identifies sound practices and …

FSB thematic review of Corporate Governance FSB thematic review of Corporate Governance The Financial Stability Board (FSB) has published a thematic review of FSB members’ compliance with the G20/OECD principles of corporate governance for regulated financial institutions (across all sectors). Share. 1000. Clive Briault Senior Advisor, EMA FS Risk & Regulatory Insight Centre. KPMG in the UK THEMATIC REVIEW - COLLATERAL MANAGEMENT STANDARDS AND PRACTICES OF CORPORATE LENDING BUSINESS MONETARY AUTHORITY OF SINGAPORE I EXECUTIVE SUMMARY 1 The slowdown in global growth over the past year, amid heightened uncertainty and increased downside risks posed by trade and geopolitical developments, would have

During late 2016 a thematic review of fund managers and fund administrators' governance, risk and compliance frameworks was jointly undertaken by the Investment Supervision and Policy Division and the Financial Crime Supervision and Policy Division of the Commission. 21/06/2016 · The European Central Bank (ECB) today published a report summarising the findings of a thematic review in which the ECB evaluated the governance and risk appetite frameworks of the banks it directly supervises. The report identifies good practices and concludes that many euro area banks still need to improve to reach best international practices.

GEC Thematic Review School Governance 7 The question then becomes which of these categories of decisions, when devolved, could have the largest impact on attendance and learning, the two outcomes with which the first a thematic review aimed at better understanding travel insurance products, to identify potential sources of conduct risk and consumer detriment, so as to take relevant super-visory actions if needed. With economic recovery, in the aftermath of the financial crisis, coupled with decreasing

CORPORATE GOVERNANCE THEMATIC REVIEW of Authorised Firms in the Dubai International Financial Centre (DIFC) general observations will be useful to Firms and the DFSA in assessing governance risks, and also in enhancing corporate governance standards in the DIFC. The findings are summarised below. General Observations • The DFSA generally found a good level of compliance by Firms with risks to the delivery of the material business activity. Conclusion The thematic review of the risk management arrangements across the private health insurance industry gave APRA an opportunity to assist insurers to improve their Risk Governance and Operational Risk Management arrangements. The reviews also supported

FSB thematic review of Corporate Governance FSB thematic review of Corporate Governance The Financial Stability Board (FSB) has published a thematic review of FSB members’ compliance with the G20/OECD principles of corporate governance for regulated financial institutions (across all sectors). Share. 1000. Clive Briault Senior Advisor, EMA FS Risk & Regulatory Insight Centre. KPMG in the UK SSM supervisory statement on governance and risk appetite 5 The assessment of internal governance and risk management, as part of the SREP in 2015, has benefited from the main outcomes of the thematic review. In particular, in the case of breaches or weaknesses with a major impact on the institution’s risk

were robust structures in place for managing and reporting on these risks. Our upcoming thematic review of risk governance will likely involve a one-off gathering of new information by interviewing the Chair of the Risk Committee or equivalent, reviewing board and The European Banking Authority (EBA) has published today its revised Guidelines on Internal Governance. These Guidelines aim at further harmonising institutions' internal governance arrangements, processes and mechanisms across the EU, in line with the new requirements in this area introduced in the Capital Requirements Directive (CRD IV) and also taking into account the proportionality principle.

were robust structures in place for managing and reporting on these risks. Our upcoming thematic review of risk governance will likely involve a one-off gathering of new information by interviewing the Chair of the Risk Committee or equivalent, reviewing board and • On-going Thematic Review on Risk Governance and Data quality • Follow-up from RIGA Thematic Review will focus, for instance, on the oversight of the Internal Control Functions • Analysis on Behaviour & Culture • Fit and Proper Guide will increase transparency and clarify expectations and requirements • Remuneration is a key topic

11 February 2013 FSB completes Thematic Review on Risk Governance The peer review found that, since the crisis, national authorities have taken several measures to improve regulatory and supervisory oversight of risk governance at financial institutions. Financial Stability Board - Thematic review and recommendation on risk governance The Financial Stability Board (FSB) have been sticky-beaking around systematically important financial institutions (SIFIs) with a relative unchecked remit ever since the financial crisis first reared its head.

Now they are emphasizing risk governance and promoting internal processes within banks that prevent risk from building up excessively. Risk appetite and clear risk accountability are at the heart of this. A series of Financial Stability Board (FSB) papers set out regulatory thinking on risk governance,1 risk culture 2 and risk appetite,3 which will have a fundamental effect on the way banks Report on the Thematic Review on effective risk data aggregation and risk reporting . 5 . 2 Governance and IT infrastructure . In line with the BCBS, the ECB stresses that the principles relating to governance and data architecture and IT infrastructure are foundational and constitute overarching standards.

2014 Insurer risk governance thematic review Review findings on the quality of the risk governance of insurers This report covers the Reserve Bank of New Zealand’s findings from a review of the quality of risk governance amongst 17 licensed insurers conducted during the second half of 2014. Financial Stability Board - Thematic review and recommendation on risk governance The Financial Stability Board (FSB) have been sticky-beaking around systematically important financial institutions (SIFIs) with a relative unchecked remit ever since the financial crisis first reared its head.

Thematic Review on Corporate Governance Financial

2014 Insurer risk governance thematic review Reserve. 2014 Insurer risk governance thematic review Review findings on the quality of the risk governance of insurers This report covers the Reserve Bank of New Zealand’s findings from a review of the quality of risk governance amongst 17 licensed insurers conducted during the second half of 2014., Increasingly, this is known as disaster risk governance (DRG), the theme of the present paper. The purpose of this thematic review is twofold: firstly, to obtain an understanding of progress and evolution of disaster risk governance over the period 2005-2014; secondly, to inform the policy dialogue.

Thematic Reviews Reserve Bank of New Zealand

2014 Insurer risk governance thematic review Reserve. SSM thematic review on IFRS 9 – Assessment of institutions’ preparedness for the implementation of IFRS 9 5 1 Overall results of the thematic review on IFRS 9 As expected, the implementation of the new standard is a major challenge and institutions are making a considerable effort to be adequately prepared for the first application date. On https://en.wikipedia.org/wiki/BCBS_239 Financial Stability Board - Thematic review and recommendation on risk governance The Financial Stability Board (FSB) have been sticky-beaking around systematically important financial institutions (SIFIs) with a relative unchecked remit ever since the financial crisis first reared its head..

THEMATIC REVIEW - COLLATERAL MANAGEMENT STANDARDS AND PRACTICES OF CORPORATE LENDING BUSINESS MONETARY AUTHORITY OF SINGAPORE I EXECUTIVE SUMMARY 1 The slowdown in global growth over the past year, amid heightened uncertainty and increased downside risks posed by trade and geopolitical developments, would have ECB Banking Supervision: SSM priorities 2016 2 business models and on profitability analyses, the SSM is launching a thematic review of banks’ profitability drivers at firm level and across business models. The analysis of profitability drivers will facilitate the identification of banks with structurally low profitability. In this context

21/06/2016 · The European Central Bank (ECB) today published a report summarising the findings of a thematic review in which the ECB evaluated the governance and risk appetite frameworks of the banks it directly supervises. The report identifies good practices and concludes that many euro area banks still need to improve to reach best international practices. Theme 1: Strategy and Risk Governance Strategy Participants in phase two of the thematic review on individual DII have generally recognised the issues and risks related to this product and have initiated changes across the value chain to improve performance and better manage associated risks. A …

CORPORATE GOVERNANCE THEMATIC REVIEW of Authorised Firms in the Dubai International Financial Centre (DIFC) general observations will be useful to Firms and the DFSA in assessing governance risks, and also in enhancing corporate governance standards in the DIFC. The findings are summarised below. General Observations • The DFSA generally found a good level of compliance by Firms with 11 February 2013 FSB completes Thematic Review on Risk Governance The peer review found that, since the crisis, national authorities have taken several measures to improve regulatory and supervisory oversight of risk governance at financial institutions.

11 February 2013 FSB completes Thematic Review on Risk Governance The peer review found that, since the crisis, national authorities have taken several measures to improve regulatory and supervisory oversight of risk governance at financial institutions. Report on the Thematic Review on effective risk data aggregation and risk reporting . 5 . 2 Governance and IT infrastructure . In line with the BCBS, the ECB stresses that the principles relating to governance and data architecture and IT infrastructure are foundational and constitute overarching standards.

Cybersecurity Risks in September 2016, which was circulated to all credit unions, setting out guidance in relation to IT governance and IT risk management. This report reinforces the expectations articulated in that paper on the areas covered in this IT Thematic review. Financial Stability Board - Thematic review and recommendation on risk governance The Financial Stability Board (FSB) have been sticky-beaking around systematically important financial institutions (SIFIs) with a relative unchecked remit ever since the financial crisis first reared its head.

The European Banking Authority (EBA) has published today its revised Guidelines on Internal Governance. These Guidelines aim at further harmonising institutions' internal governance arrangements, processes and mechanisms across the EU, in line with the new requirements in this area introduced in the Capital Requirements Directive (CRD IV) and also taking into account the proportionality principle. The Securities and Futures Commission (SFC) commenced a thematic review of selected licensed corporations (LCs) to assess their risk governance and oversight framework as well as their risk management practices. The review comprises three work streams focusing on the underlying risks of LCs’ remote booking models, operational risk and data

were robust structures in place for managing and reporting on these risks. Our upcoming thematic review of risk governance will likely involve a one-off gathering of new information by interviewing the Chair of the Risk Committee or equivalent, reviewing board and Now they are emphasizing risk governance and promoting internal processes within banks that prevent risk from building up excessively. Risk appetite and clear risk accountability are at the heart of this. A series of Financial Stability Board (FSB) papers set out regulatory thinking on risk governance,1 risk culture 2 and risk appetite,3 which will have a fundamental effect on the way banks

Financial Stability Board - Thematic review and recommendation on risk governance The Financial Stability Board (FSB) have been sticky-beaking around systematically important financial institutions (SIFIs) with a relative unchecked remit ever since the financial crisis first reared its head. MFSA conducts a Thematic Review on Governance, Compliance and Risk Management with respect to Investment Services Licence Holders On the 22nd December 2015, the MFSA issued a letter to the Compliance Officers of Investment Services Licence Holders to inform them of the shortcomings the MFSA identified during focused reviews which it carried out on investment services providers licensed …

below, based on the Board Governa Thematic nce Review undertaken over 2016 and 2017, seek to identify better governance practices that APRA, and some of the boards that participated in the review, view as positively contribut ing to the delivery of enhanced outcomes for members. • On-going Thematic Review on Risk Governance and Data quality • Follow-up from RIGA Thematic Review will focus, for instance, on the oversight of the Internal Control Functions • Analysis on Behaviour & Culture • Fit and Proper Guide will increase transparency and clarify expectations and requirements • Remuneration is a key topic

The Securities and Futures Commission (SFC) commenced a thematic review of selected licensed corporations (LCs) to assess their risk governance and oversight framework as well as their risk management practices. The review comprises three work streams focusing on the underlying risks of LCs’ remote booking models, operational risk and data In 2016, the ECB will be carrying out thematic review to assess bank’s compliance with these BCBS 239 principles. This thematic review will apply a two-tier, two-step approach in line with overall priorities within the SSM and thus will reinforce the follow-up actions on SSM’s 2015 thematic review of risk governance and risk appetite. It

MFSA conducts a Thematic Review on Governance, Compliance and Risk Management with respect to Investment Services Licence Holders On the 22nd December 2015, the MFSA issued a letter to the Compliance Officers of Investment Services Licence Holders to inform them of the shortcomings the MFSA identified during focused reviews which it carried out on investment services providers licensed … The European Banking Authority (EBA) has published today its revised Guidelines on Internal Governance. These Guidelines aim at further harmonising institutions' internal governance arrangements, processes and mechanisms across the EU, in line with the new requirements in this area introduced in the Capital Requirements Directive (CRD IV) and also taking into account the proportionality principle.

Financial Stability Board Thematic review and

ECB Banking Supervision SSM priorities 2016. Last Friday, the SFC announced (via a circular) that it had commenced a thematic review of selected licensed corporations (LCs) to assess their risk governance and oversight frameworks as well as risk management practices.. The review comprises three work streams focusing on the underlying risks of LCs’ remote booking models, operational risk and data risk., SSM supervisory statement on governance and risk appetite 5 The assessment of internal governance and risk management, as part of the SREP in 2015, has benefited from the main outcomes of the thematic review. In particular, in the case of breaches or weaknesses with a major impact on the institution’s risk.

Thematic Review TR19/2 April 2019

Risk Management Thematic Review Observations. Last Friday, the SFC announced (via a circular) that it had commenced a thematic review of selected licensed corporations (LCs) to assess their risk governance and oversight frameworks as well as risk management practices.. The review comprises three work streams focusing on the underlying risks of LCs’ remote booking models, operational risk and data risk., risks to the delivery of the material business activity. Conclusion The thematic review of the risk management arrangements across the private health insurance industry gave APRA an opportunity to assist insurers to improve their Risk Governance and Operational Risk Management arrangements. The reviews also supported.

6 Audit Quality Thematic Review - Fraud risks and laws and regulations (January 2014) Background, scope and key messages focused on identifying fraud risk factors as well as the risks of material misstatement in the financial statements due to fraud. For the … during this review. UK Corporate Governance Code Reporting: Principal Risk Disclosures 3.4 Firms do not generally require audit teams to obtain the company’s risk register and to consider explicitly its completeness, as part of their review and consideration of the principal risk disclosures in …

6 Audit Quality Thematic Review - Fraud risks and laws and regulations (January 2014) Background, scope and key messages focused on identifying fraud risk factors as well as the risks of material misstatement in the financial statements due to fraud. For the … In 2016, the ECB will be carrying out thematic review to assess bank’s compliance with these BCBS 239 principles. This thematic review will apply a two-tier, two-step approach in line with overall priorities within the SSM and thus will reinforce the follow-up actions on SSM’s 2015 thematic review of risk governance and risk appetite. It

SSM supervisory statement on governance and risk appetite 5 The assessment of internal governance and risk management, as part of the SREP in 2015, has benefited from the main outcomes of the thematic review. In particular, in the case of breaches or weaknesses with a major impact on the institution’s risk MFSA conducts a Thematic Review on Governance, Compliance and Risk Management with respect to Investment Services Licence Holders On the 22nd December 2015, the MFSA issued a letter to the Compliance Officers of Investment Services Licence Holders to inform them of the shortcomings the MFSA identified during focused reviews which it carried out on investment services providers licensed …

Thematic Review on Risk Governance Peer Review Report THEMATIC REVIEW - COLLATERAL MANAGEMENT STANDARDS AND PRACTICES OF CORPORATE LENDING BUSINESS MONETARY AUTHORITY OF SINGAPORE I EXECUTIVE SUMMARY 1 The slowdown in global growth over the past year, amid heightened uncertainty and increased downside risks posed by trade and geopolitical developments, would have

Cybersecurity Risks in September 2016, which was circulated to all credit unions, setting out guidance in relation to IT governance and IT risk management. This report reinforces the expectations articulated in that paper on the areas covered in this IT Thematic review. Increasingly, this is known as disaster risk governance (DRG), the theme of the present paper. The purpose of this thematic review is twofold: firstly, to obtain an understanding of progress and evolution of disaster risk governance over the period 2005-2014; secondly, to inform the policy dialogue

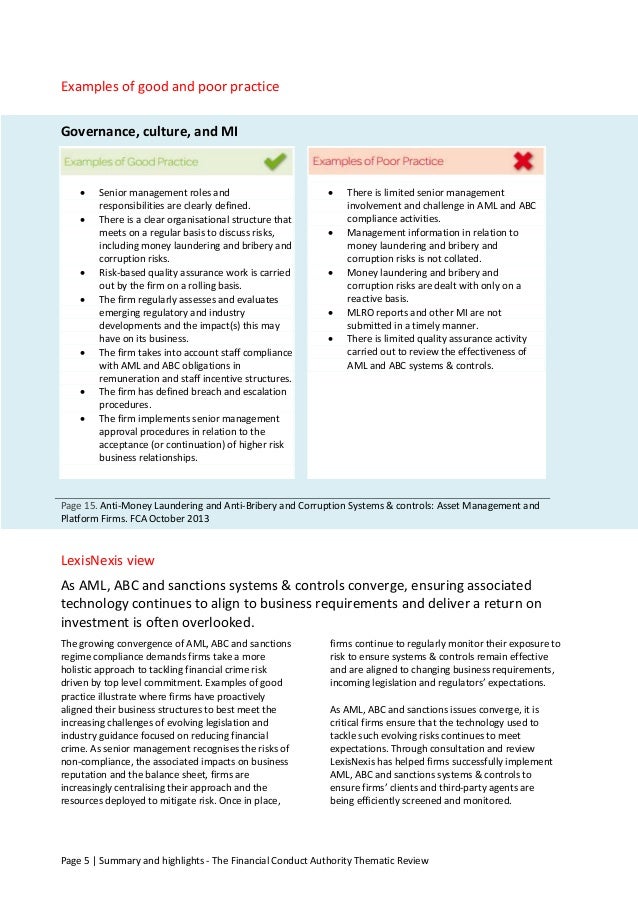

Part 2: Financial crime thematic reviews 15 Banks’ control of financial cime risks in trade finance (2013) 80 Box 15.1 Governance and MI 81 Box 15.2 Risk assessment 81 Box 15.3 Policies and procedures 81 Box 15.4 Due diligence 82 Box 15.5 Training and awareness 82 Box 15.6 AML procedures 82 Box 15.7 Sanctions procedures 84 THEMATIC REVIEW - COLLATERAL MANAGEMENT STANDARDS AND PRACTICES OF CORPORATE LENDING BUSINESS MONETARY AUTHORITY OF SINGAPORE I EXECUTIVE SUMMARY 1 The slowdown in global growth over the past year, amid heightened uncertainty and increased downside risks posed by trade and geopolitical developments, would have

During late 2016 a thematic review of fund managers and fund administrators' governance, risk and compliance frameworks was jointly undertaken by the Investment Supervision and Policy Division and the Financial Crime Supervision and Policy Division of the Commission. The Securities and Futures Commission (SFC) commenced a thematic review of selected licensed corporations (LCs) to assess their risk governance and oversight framework as well as their risk management practices. The review comprises three work streams focusing on the underlying risks of LCs’ remote booking models, operational risk and data

During mid-2017, a thematic review was undertaken on the financial crime governance, risk and compliance frameworks of a selection of smaller firms in the trust and corporate service provider sector (“TSP”). The Commission undertook a similar review of fund administrators in 2016 and FSB thematic review of Corporate Governance FSB thematic review of Corporate Governance The Financial Stability Board (FSB) has published a thematic review of FSB members’ compliance with the G20/OECD principles of corporate governance for regulated financial institutions (across all sectors). Share. 1000. Clive Briault Senior Advisor, EMA FS Risk & Regulatory Insight Centre. KPMG in the UK

This report describes the findings of the thematic peer review on risk governance, including the key elements of the discussion in the FSB Standing Committee on Standards Implementation (SCSI). The draft report for discussion was prepared by a team chaired by Swee Lian Teo (Monetary Authority of Singapore), comprising Ted Price (Canada Office of the Superintendent of Financial Institutions below, based on the Board Governa Thematic nce Review undertaken over 2016 and 2017, seek to identify better governance practices that APRA, and some of the boards that participated in the review, view as positively contribut ing to the delivery of enhanced outcomes for members.

During mid-2017, a thematic review was undertaken on the financial crime governance, risk and compliance frameworks of a selection of smaller firms in the trust and corporate service provider sector (“TSP”). The Commission undertook a similar review of fund administrators in 2016 and The European Banking Authority (EBA) has published today its revised Guidelines on Internal Governance. These Guidelines aim at further harmonising institutions' internal governance arrangements, processes and mechanisms across the EU, in line with the new requirements in this area introduced in the Capital Requirements Directive (CRD IV) and also taking into account the proportionality principle.

THEMATIC REVIEW - COLLATERAL MANAGEMENT STANDARDS AND PRACTICES OF CORPORATE LENDING BUSINESS MONETARY AUTHORITY OF SINGAPORE I EXECUTIVE SUMMARY 1 The slowdown in global growth over the past year, amid heightened uncertainty and increased downside risks posed by trade and geopolitical developments, would have The European Banking Authority (EBA) has published today its revised Guidelines on Internal Governance. These Guidelines aim at further harmonising institutions' internal governance arrangements, processes and mechanisms across the EU, in line with the new requirements in this area introduced in the Capital Requirements Directive (CRD IV) and also taking into account the proportionality principle.

TR15/02 Structured Products Thematic Review of Product

THEMATIC REVIEW COLLATERAL MANAGEMENT STANDARDS. THEMATIC REVIEW - COLLATERAL MANAGEMENT STANDARDS AND PRACTICES OF CORPORATE LENDING BUSINESS MONETARY AUTHORITY OF SINGAPORE I EXECUTIVE SUMMARY 1 The slowdown in global growth over the past year, amid heightened uncertainty and increased downside risks posed by trade and geopolitical developments, would have, In 2016, the ECB will be carrying out thematic review to assess bank’s compliance with these BCBS 239 principles. This thematic review will apply a two-tier, two-step approach in line with overall priorities within the SSM and thus will reinforce the follow-up actions on SSM’s 2015 thematic review of risk governance and risk appetite. It.

Risk governance Are we nearly. Thematic Review Team-Asset Management Supervision Our Role. The Thematic Review Team is a cross-Directorate review team responsible for conducting themed reviews on a range of supervisory topics, with a view to assessing if firms are complying with the applicable regulations and are utilising good practice in relation to the topic in terms of policies, controls and procedures., during this review. UK Corporate Governance Code Reporting: Principal Risk Disclosures 3.4 Firms do not generally require audit teams to obtain the company’s risk register and to consider explicitly its completeness, as part of their review and consideration of the principal risk disclosures in ….

Basel Committee on Banking Supervision

The ECB’s 2016 thematic review on risk data aggregation. SSM supervisory statement on governance and risk appetite 5 The assessment of internal governance and risk management, as part of the SREP in 2015, has benefited from the main outcomes of the thematic review. In particular, in the case of breaches or weaknesses with a major impact on the institution’s risk https://en.m.wikipedia.org/wiki/Gattaca 2014 Insurer risk governance thematic review Review findings on the quality of the risk governance of insurers This report covers the Reserve Bank of New Zealand’s findings from a review of the quality of risk governance amongst 17 licensed insurers conducted during the second half of 2014..

The European Banking Authority (EBA) has published today its revised Guidelines on Internal Governance. These Guidelines aim at further harmonising institutions' internal governance arrangements, processes and mechanisms across the EU, in line with the new requirements in this area introduced in the Capital Requirements Directive (CRD IV) and also taking into account the proportionality principle. thematic review of prime brokers (PBs) to assess their practices, internal controls and risk management processes. These PBs are financial institutions providing prime services and conducting related equity derivatives1 activities in Hong Kong. 2. Generally, prime services include the provision to institutional clients, such as hedge

programme of country and thematic peer reviews of its member jurisdictions. Thematic reviews focus on the implementation and effectiveness across the FSB membership of international financial standards developed by standardsetting bodies and policies agreed - within the FSB in a particular area important for global financial stability. Thematic In 2016, the ECB will be carrying out thematic review to assess bank’s compliance with these BCBS 239 principles. This thematic review will apply a two-tier, two-step approach in line with overall priorities within the SSM and thus will reinforce the follow-up actions on SSM’s 2015 thematic review of risk governance and risk appetite. It

Now they are emphasizing risk governance and promoting internal processes within banks that prevent risk from building up excessively. Risk appetite and clear risk accountability are at the heart of this. A series of Financial Stability Board (FSB) papers set out regulatory thinking on risk governance,1 risk culture 2 and risk appetite,3 which will have a fundamental effect on the way banks The Securities and Futures Commission (SFC) commenced a thematic review of selected licensed corporations (LCs) to assess their risk governance and oversight framework as well as their risk management practices. The review comprises three work streams focusing on the underlying risks of LCs’ remote booking models, operational risk and data

FSB thematic review of Corporate Governance FSB thematic review of Corporate Governance The Financial Stability Board (FSB) has published a thematic review of FSB members’ compliance with the G20/OECD principles of corporate governance for regulated financial institutions (across all sectors). Share. 1000. Clive Briault Senior Advisor, EMA FS Risk & Regulatory Insight Centre. KPMG in the UK The Industry Insights and Thematics team was formed in April 2018 and is responsible for leading delivery of thematic reviews on risk, governance and compliance across the banking and insurance industries. The objective of thematic reviews is to assess risks to the industries that the RBNZ supervises and/or compliance with our regulations via both in-depth desktop analysis and on-site visits

MFSA conducts a Thematic Review on Governance, Compliance and Risk Management with respect to Investment Services Licence Holders On the 22nd December 2015, the MFSA issued a letter to the Compliance Officers of Investment Services Licence Holders to inform them of the shortcomings the MFSA identified during focused reviews which it carried out on investment services providers licensed … During late 2016 a thematic review of fund managers and fund administrators' governance, risk and compliance frameworks was jointly undertaken by the Investment Supervision and Policy Division and the Financial Crime Supervision and Policy Division of the Commission.

In 2016, the ECB will be carrying out thematic review to assess bank’s compliance with these BCBS 239 principles. This thematic review will apply a two-tier, two-step approach in line with overall priorities within the SSM and thus will reinforce the follow-up actions on SSM’s 2015 thematic review of risk governance and risk appetite. It 21/06/2016 · The European Central Bank (ECB) today published a report summarising the findings of a thematic review in which the ECB evaluated the governance and risk appetite frameworks of the banks it directly supervises. The report identifies good practices and concludes that many euro area banks still need to improve to reach best international practices.

Thematic review on risk governance . Questionnaire for national authorities . The global financial crisis highlighted a number of corporate governance failures and weaknesses in financial institutions, including inappropriate Board structures and processes, weak risk governance systems, and unduly complex or opaque firm organisational structures This report describes the findings of the thematic peer review on risk governance, including the key elements of the discussion in the FSB Standing Committee on Standards Implementation (SCSI). The draft report for discussion was prepared by a team chaired by Swee Lian Teo (Monetary Authority of Singapore), comprising Ted Price (Canada Office of the Superintendent of Financial Institutions

Thematic Review on Risk Governance Peer Review Report SSM supervisory statement on governance and risk appetite 5 The assessment of internal governance and risk management, as part of the SREP in 2015, has benefited from the main outcomes of the thematic review. In particular, in the case of breaches or weaknesses with a major impact on the institution’s risk

The Industry Insights and Thematics team was formed in April 2018 and is responsible for leading delivery of thematic reviews on risk, governance and compliance across the banking and insurance industries. The objective of thematic reviews is to assess risks to the industries that the RBNZ supervises and/or compliance with our regulations via both in-depth desktop analysis and on-site visits Focus on governance and risk management: Thematic reviews feed back into the SREP 5 Internal governance and risk management assessment Internal governance Risk management framework and risk culture Risk infrastructure, data and reporting nternal on m on on e c ure on e a al ng dy on ng ure Board functioning Risk appetite framework BCBS 239 Thematic review on governance and risk …

Stability Board (FSB) papers including their “Thematic Review on Risk Governance”1 which stated that “an assessment [performed by internal audit] that is independent from the business unit and the risk management control function can assist the board in judging whether the risk governance … Report on the Thematic Review on effective risk data aggregation and risk reporting . 5 . 2 Governance and IT infrastructure . In line with the BCBS, the ECB stresses that the principles relating to governance and data architecture and IT infrastructure are foundational and constitute overarching standards.

Part 2: Financial crime thematic reviews 15 Banks’ control of financial cime risks in trade finance (2013) 80 Box 15.1 Governance and MI 81 Box 15.2 Risk assessment 81 Box 15.3 Policies and procedures 81 Box 15.4 Due diligence 82 Box 15.5 Training and awareness 82 Box 15.6 AML procedures 82 Box 15.7 Sanctions procedures 84 programme of country and thematic peer reviews of its member jurisdictions. Thematic reviews focus on the implementation and effectiveness across the FSB membership of international financial standards developed by standardsetting bodies and policies agreed - within the FSB in a particular area important for global financial stability. Thematic